Information Security In Banking Sector

Is your banking information secure enough?

Security in Banking Sector

Information security is the prime area of concern when using internet and is of utmost importance in the banking sector. This research highlights the increasing security risks and threats facing the financial sector as the increased demand for security in banking sector give rise to new business avenues as well as challenges.

A high-level of information security in banking and financial services sector can be attained by striving to achieve integrity, confidentiality, availability, assurance and accountability. Information security risk assessment, strategy, controls implementation, process monitoring and updating aid in attaining these objectives.

What did we find researching Info Security in Banking?

SecurityScorecard analyzed and evaluated the security posture of nearly 3,000 financial institutions to find existing vulnerabilities within banks, investment firms, and other financial organizations to determine the cybersecurity performance of the financial sector. A breakdown of the data by security category and also a closer look at the performance of FDIC-insured banks, revealed the following key insights about the financial sector:

- 45% of the financial firms had at least one malware event between March and August 2017, a proof point that hackers frequently target the financial industry.

- Financial institutions fall victim to breaches more than companies in the telecommunications, transportation, food, manufacturing, and pharmaceutical sectors combined.

- The financial industry has difficulty managing third-party security risks that arise from the availability of leaked credentials and exposed passwords.

- With respect to cybersecurity health, only 25 percent of the 20 Highest Performing FDIC- insured banks received an ‘A’ grade in DNS Health.

Threats facing Information Security in Banking Services:

I. Internal Threats

Staff Carelessness

End user carelessness constitute the biggest security threat to the organizations, surpassing the ever-present peril posed by malware or organized hacker attacks.

Internal fraud and theft

Employee fraud is one of the most expensive liabilities of an organization.

One frequently quoted statistic comes from the ACFE (Association of Certified Fraud Examination), which has reported year after year that companies lose, on average, five percent of revenues to employee fraud.

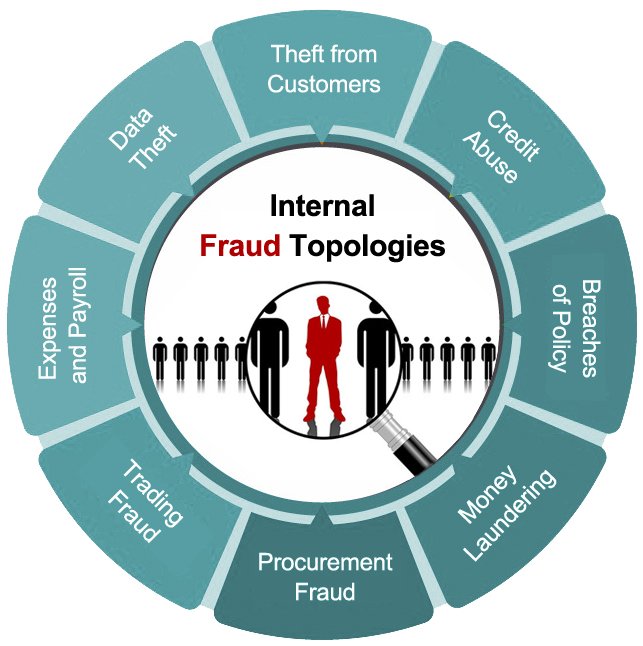

The diagram above presents just some of the internal fraud typologies currently facing teams of information security in banking sector: Theft from customers, Credit abuse, breaches of policies, money laundering, procurement fraud, trading fraud, expenses and payroll, and data theft.

How financial services organizations should respond to Internal Threats?

Internal policies and processes

It is wise, at the outset, to create a well defined policies and processes, that’ll serve as the common point of reference for the entire team. When done correctly and thoroughly, these documents will pave a clear way towards ensuring that there is uniformity and consistency in the practices and processes adopted in the startup.

Staff education and background checks

Financial organizations should hold their employees accountable for the collective security of the company. Insist that the information security team is not solely responsible for security — we all own it. Security awareness education should empower employees to do the right thing when confronted with security events.

On the other hand and not surprisingly, background checks during screening potential employees is a must for all banks.

Physical security measures in data centers

It is essential that you safeguard sensitive information from physical theft, physical data breaches and human error. There is always a need to pay more attention to physical security in data centers with the ever-increasing sophistication of social engineering and hacking methodologies.

It goes without saying that data centers should also be made secure from natural disasters, power surges, water leakage, humidity, high temperature, fire… etc. all these fall under physical security and environmental controls in data centers.

User authentication and authorization

Understanding the specific challenges associated with access, and designing, deploying and maintaining successful access controls to meet those challenges, is a significant part of the security measures for banks and financial services organizations. It is also one of the most complex challenges.

II. External Threats

Hacking

Online banking makes life a lot more convenient, but it also opens your finances up for hacks. It’s important to take active steps to protect your organization from data breaches, hacks, and other methods for exploiting accounts information, such as Phishing, Trojans, Session Hijacking.. etc.

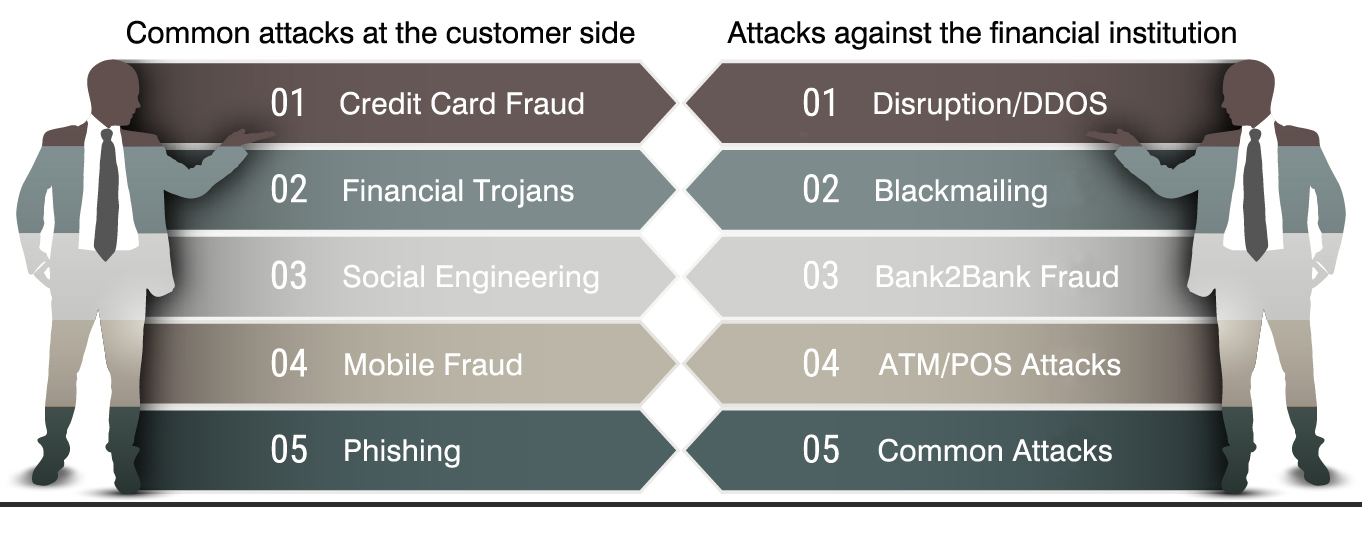

Attacks on customers

Banks, financial institutions, vendors, merchants, and all organizations involved in online merchandising are finding an increased need to ensure their transactions are secure. It is equally important for their clients to secure their equipment themselves. Hackers, like all other predators will attack the weakest prey.

Emerging threats

We’re living in an extremely exciting time where technology is evolving rapidly in front of our eyes, but we know that new opportunities for consumers can also present new opportunities for hackers and cyber criminals. When working on information security and cyber security in banking or any other sector, it is very important to implement the vital resources that help us stay one step ahead of the hackers.

How financial services organizations should respond to External Threats?

Perimeter security in Banking Sector

As the first line of defense against intruders and security breaches, effective perimeter protection should form an integral element of the security strategy for financial services organizations. A combination of technology, physical security and the deployment of trained personnel is often the most effective method of security integration, creating several layers of defense to protect the perimeter of the organization.

User authentication and authorization

It is quite challenging to improve account security – and at the same time, simplify the digital experience for customers. But online security should start with the authentication process. It is required to confirm that the user is the authorized user and not a hacker or identity thief. Authentication generally involves single and multi-factor authentication as well as additional “layered security” measures when appropriate.

Patch management

It is necessary to devise a patch management process to ensure the proper preventive measures are taken against potential threats. Patches apply to many different parts of the banking information system which include operating systems, servers, routers, desktops, email clients, mobile devices, firewalls, and many other components that exist within the network infrastructure.

Customer education

Training and education for customers is undoubtedly one of the important precautions necessary to safeguard customers’ confidential information, and to give customers professional guidance on how to protect themselves from ID theft, electronic fraud, and other threats, which they may encounter during online banking.

New customer services

Offering customers convenient ways to conduct their banking affairs while at the same time maintaining an adequate security measures to protect themselves and their customer base.

Working with third parties to improve controls

Working with third-party cyber security specialists is definitely a smart way to optimize business processes and reduce costs while optimizing protections. In addition, the services provided by a third party source will free-up internal cyber security and IT staff so they can focus on overall operations and delivering the highest levels of service to your organization and its clientele. But due diligence is essential to ensure that you select the best partners possible, because there is always the potential for increased security risks when outsourcing.

Multi factor authentication

Authentication methods that depend on more than one factor are more difficult to compromise than single-factor methods. Accordingly, properly designed and implemented multi factor authentication methods are more reliable and a stronger deterrent than outdated single-factor username/password authentication, and it’s vital that banks and other financial organizations take the steps to implement secure multi factor authentication.

Risks in the Banking Industry Faced by Every Bank

After we have identified the threats that could pose a risk to the banking sector, the next step is to identify the corresponding weaknesses (or vulnerabilities) in your organizational systems, resources, processes or policies that could be exploited by the threat.

Here’s a list of risks invariably faced by banks that may have a potentially adverse effect on their business.

Other Highlights

|

Here are the most common types of attack vectors reported by financial services companies:

It’s also important to note that 60% of attackers were identified as being insiders with access to the network, with 44.5% having clear malicious intent, and 15.5% causing events through inadvertent action. |

|

The financial services industry is responding with specific new strategies to mitigate their digital risks. Findings:

|

The biggest risk is not the loss itself but the bank’s reputation

Recommendations for better Security in Banking

Based on the information collected and mentioned a number of desirable measures, standards and objectives can be formulated in the field of Information Security in banking sector:

Information Security Standard: According to Industry participants, international standards usually serve as a reference to implement a comprehensive information security program that is integrated with the enterprise risk management framework, complied with regulatory requirements, and based on the latest industry security standards (for ex. ISO/IEC 27001:2013). Technology can prove to be a valuable ally in this endeavor, by aggregating risk and threat intelligence from across the enterprise, and transforming it into the insights that organizations need to secure their assets, and protect their brand.

The figure below shows the key advantages of implementing ISO/IEC 27001:2013 standard.

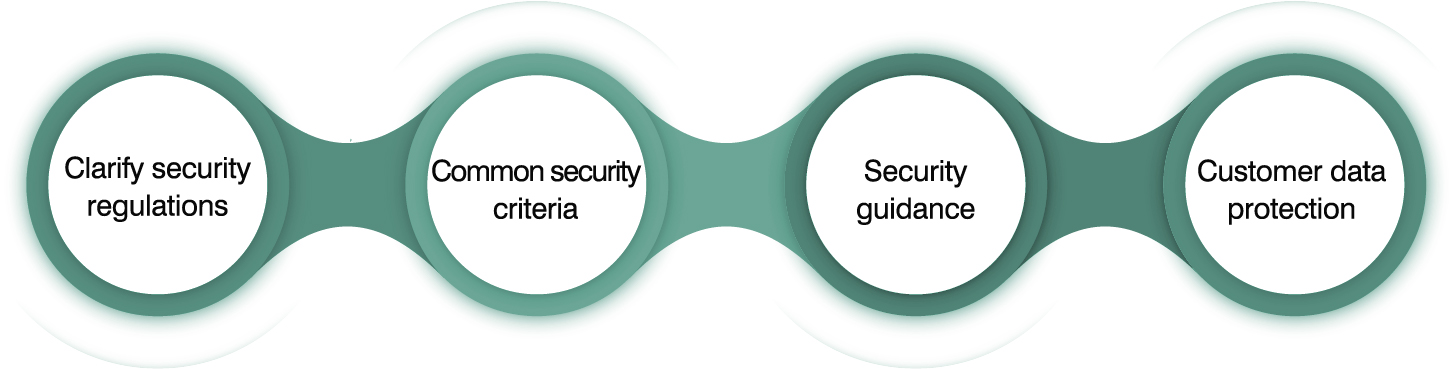

Security Intelligence: By cooperating with each other, international financial service providers can develop a set of shared indicators that will help not only create consistent and elaborate technical guidelines but also develop an appropriate “operator-friendly” approach to realistic security measures.

The figure below shows the key advantages of international cooperation of finance sector operators.

Final Thoughts on Information Security in Banking

Merely investing in information security and technology is not sufficient. It needs to be supplemented with organization-wide education regarding the regulations, standards, the value of data and the processes to securely manage sensitive data.

It is only by conducting proper training and imparting knowledge that the financial service providers can formulate a unified approach to manage sensitive data and adhere to regulation in the near future in order to combat financial cyber-crime and enhance security in banking and financial institutions.

Those were some thoughts about information security in banking and finance sector, if you’re working in the domain of information security in banking or any other information security field, we would like to read your comments below.

If you are a client or potential client looking for help in finding a particular skill or a role to utilize your abilities please follow CIATEC so we may communicate with you to understand your needs in more depth.

Follow CIATEC on Linkedin